U.S.-China chip war opens up on new fronts

Beijing has opened a case at the World Trade Organization against new U.S. export curbs meant to limit China’s ability to make high-end semiconductor chips often used for military purposes, creating a new front in a simmering battle for control of the crucial industry.

The complaint comes amid reports key global chipmakers Japan and the Netherlands are nearing a deal to join the U.S. export curbs, which could cut China off from the ability to make cutting-edge chips.

It also comes as Beijing hustles to react to American and European efforts to entice chipmakers back to their own shores: China is now considering a U.S.$140 billion package to support its industry, Reuters reported on Tuesday, some four months after the $280-billion U.S. CHIPS Act, and as the European Union nears a deal of its own.

Beijing’s WTO complaint claims the United States is engaging in “trade protectionism” by seeking to limit Chinese companies from making advanced chips at the same time as it subsidizes its own industry, even as U.S. lawmakers say the policies are needed for national security.

Trade rule exceptions

The WTO carves out large exceptions to global trade rules when it comes to national security, but the body just last week ruled against the United States on a complaint brought by Beijing against Trump-era steel tariffs that were introduced on national security grounds.

Even so, Pranay Kotasthane, an expert on semiconductor chip geopolitics at the Takshashila Institution in Bengaluru, India, said he believed U.S. chip policies had a clear enough national security application to create “limited options” for China at the WTO.

“WTO case is proforma,” Kotasthane wrote on Twitter. “Given that WTO has exceptions for national security concerns, which can be defined broadly, it"s unlikely to result in any policy changes.”

WTO disputes can also take years to resolve, by which time the fast-paced chip industry is likely to have moved on to more advanced technology, potentially leaving China struggling to catch up.

“It is clear that the export controls are broad enough to slow down not just Chinese military capabilities but also advancements in its commercial semiconductor sector,” Kotasthane wrote.

Making matters worse for China, the Netherlands and Japan, which are China’s only other hopes for an alternative source from which to import the components now subject to the U.S. export curbs, are reportedly nearing a deal with the United States to introduce similar curbs.

U.S. chip supply concerns

The Biden administration has this year introduced three key chip industry policies: the subsidies of the CHIPS Act, which was signed into law in August, and two export curbs unveiled Oct. 7. The first limits American companies from selling components needed to make advanced chips to Chinese firms, and the second bans U.S. citizens and permanent residents from working for Chinese chipmakers.

The policies followed fears the United States could itself be cut off from chips – a key component for many consumer goods as well as military hardware – if there was a conflict over Taiwan or a blockade by China, which claims the democratic island is a renegade province and has promised never to “renounce the use of force” to reclaim it.

U.S. lawmakers and Biden administration officials have been clear about the link between Taiwan and the global chip industry.

“On semiconductors, if Taiwanese production were disrupted as a result of a crisis, you would have an economic crisis around the world,” U.S. Secretary of State Antony Blinken said in an Oct. 17 speech in which he warned China was speeding up plans to seize the island.

Such a crisis would be particularly bad for the United States, with American manufacturers potentially cut off from chips needed to make weapons to defend Taiwan right when they are most needed.

The U.S. Semiconductor Industry Association, for instance, says the share of chips made in the United States has fallen from 37% of global totals in 1990 to just 12% today, with the bulk now produced in Taiwan, mainland China and South Korea, where production costs are lower.

TSMC dominance

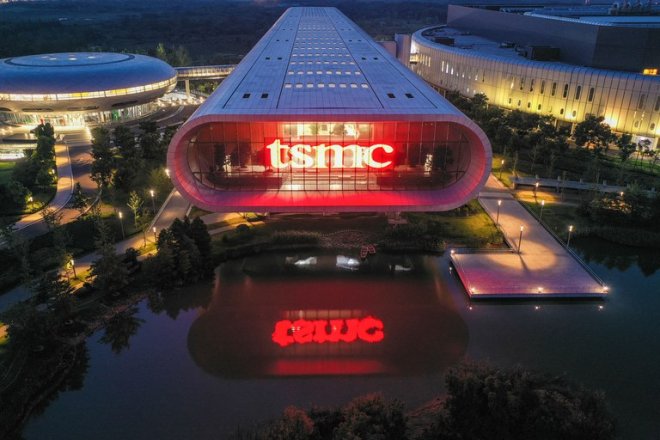

Instead, the global industry has come to be dominated by the Taiwan Semiconductor Manufacturing Company, which was founded in 1987 by Taiwanese-American businessman Morris Chang and now accounts for half of all global semiconductor chip production by revenue.

![]()

American multibillionaire Ken Griffin, who heads the international hedge fund Citadel, said at a Bloomberg event on Nov. 15 that the U.S. reliance on Taiwan for chips – and the Chinese reliance on U.S.-made technology for chips – meant policies made in Washington and Beijing could have wide-reaching consequences, including a real conflict.

“We are utterly, totally dependent upon the Taiwanese for modern semiconductors in America. Now, you could argue that by depriving the Chinese of access to semiconductors, we actually upped the ante of the risk that they seize Taiwan,” Griffin said, noting Beijing “could resort to other methods to secure this needed technology, if they so choose.”

“We"re playing with fire here,” Griffin added. “Let"s be very clear, if we lose access to Taiwanese semiconductors, the hit to U.S. GDP is probably an automatic 5 to 10%. It"s an immediate great depression.”

U.S.-China decoupling

The new U.S. policies are already causing shifts in the industry.

After years expanding operations in mainland China, the 91-year-old Chang last Tuesday broke ground on TSMC’s first new high-tech foundry in the United States in more than two decades. At the ceremony, he noted the “big geopolitical situation change” that was hitting the industry and creating two parallel chip industries.

“Globalization is almost dead, and free trade is almost dead,” Chang said at the new Phoenix, Arizona, TSMC plant. “A lot of people still wish they would come back, but I don"t think they will be back.”

Chang is also not the only one to reach that conclusion.

Former Australian Prime Minister Kevin Rudd, who now heads the Asia Society in the United States, told Eurasia Group founder Ian Bremmer at an event in New York last month the American export curbs would come to be seen as a critical moment in any U.S.-China decoupling.

“When the history is written of this period, the decision by the administration on the 7th of October to ban high-technology exports to China is a tipping point,” Rudd said. “It’s a central development, which we will look back on in the evolution of not just technological decoupling, but wider economic decoupling.”

Edited by Malcolm Foster.

[圖擷取自網路,如有疑問請私訊]

The complaint comes amid reports key global chipmakers Japan and the Netherlands are nearing a deal to join the U.S. export curbs, which could cut China off from the ability to make cutting-edge chips.

It also comes as Beijing hustles to react to American and European efforts to entice chipmakers back to their own shores: China is now considering a U.S.$140 billion package to support its industry, Reuters reported on Tuesday, some four months after the $280-billion U.S. CHIPS Act, and as the European Union nears a deal of its own.

Beijing’s WTO complaint claims the United States is engaging in “trade protectionism” by seeking to limit Chinese companies from making advanced chips at the same time as it subsidizes its own industry, even as U.S. lawmakers say the policies are needed for national security.

Trade rule exceptions

The WTO carves out large exceptions to global trade rules when it comes to national security, but the body just last week ruled against the United States on a complaint brought by Beijing against Trump-era steel tariffs that were introduced on national security grounds.

Even so, Pranay Kotasthane, an expert on semiconductor chip geopolitics at the Takshashila Institution in Bengaluru, India, said he believed U.S. chip policies had a clear enough national security application to create “limited options” for China at the WTO.

“WTO case is proforma,” Kotasthane wrote on Twitter. “Given that WTO has exceptions for national security concerns, which can be defined broadly, it"s unlikely to result in any policy changes.”

WTO disputes can also take years to resolve, by which time the fast-paced chip industry is likely to have moved on to more advanced technology, potentially leaving China struggling to catch up.

“It is clear that the export controls are broad enough to slow down not just Chinese military capabilities but also advancements in its commercial semiconductor sector,” Kotasthane wrote.

Making matters worse for China, the Netherlands and Japan, which are China’s only other hopes for an alternative source from which to import the components now subject to the U.S. export curbs, are reportedly nearing a deal with the United States to introduce similar curbs.

U.S. chip supply concerns

The Biden administration has this year introduced three key chip industry policies: the subsidies of the CHIPS Act, which was signed into law in August, and two export curbs unveiled Oct. 7. The first limits American companies from selling components needed to make advanced chips to Chinese firms, and the second bans U.S. citizens and permanent residents from working for Chinese chipmakers.

The policies followed fears the United States could itself be cut off from chips – a key component for many consumer goods as well as military hardware – if there was a conflict over Taiwan or a blockade by China, which claims the democratic island is a renegade province and has promised never to “renounce the use of force” to reclaim it.

U.S. lawmakers and Biden administration officials have been clear about the link between Taiwan and the global chip industry.

“On semiconductors, if Taiwanese production were disrupted as a result of a crisis, you would have an economic crisis around the world,” U.S. Secretary of State Antony Blinken said in an Oct. 17 speech in which he warned China was speeding up plans to seize the island.

Such a crisis would be particularly bad for the United States, with American manufacturers potentially cut off from chips needed to make weapons to defend Taiwan right when they are most needed.

The U.S. Semiconductor Industry Association, for instance, says the share of chips made in the United States has fallen from 37% of global totals in 1990 to just 12% today, with the bulk now produced in Taiwan, mainland China and South Korea, where production costs are lower.

TSMC dominance

Instead, the global industry has come to be dominated by the Taiwan Semiconductor Manufacturing Company, which was founded in 1987 by Taiwanese-American businessman Morris Chang and now accounts for half of all global semiconductor chip production by revenue.

American multibillionaire Ken Griffin, who heads the international hedge fund Citadel, said at a Bloomberg event on Nov. 15 that the U.S. reliance on Taiwan for chips – and the Chinese reliance on U.S.-made technology for chips – meant policies made in Washington and Beijing could have wide-reaching consequences, including a real conflict.

“We are utterly, totally dependent upon the Taiwanese for modern semiconductors in America. Now, you could argue that by depriving the Chinese of access to semiconductors, we actually upped the ante of the risk that they seize Taiwan,” Griffin said, noting Beijing “could resort to other methods to secure this needed technology, if they so choose.”

“We"re playing with fire here,” Griffin added. “Let"s be very clear, if we lose access to Taiwanese semiconductors, the hit to U.S. GDP is probably an automatic 5 to 10%. It"s an immediate great depression.”

U.S.-China decoupling

The new U.S. policies are already causing shifts in the industry.

After years expanding operations in mainland China, the 91-year-old Chang last Tuesday broke ground on TSMC’s first new high-tech foundry in the United States in more than two decades. At the ceremony, he noted the “big geopolitical situation change” that was hitting the industry and creating two parallel chip industries.

“Globalization is almost dead, and free trade is almost dead,” Chang said at the new Phoenix, Arizona, TSMC plant. “A lot of people still wish they would come back, but I don"t think they will be back.”

Chang is also not the only one to reach that conclusion.

Former Australian Prime Minister Kevin Rudd, who now heads the Asia Society in the United States, told Eurasia Group founder Ian Bremmer at an event in New York last month the American export curbs would come to be seen as a critical moment in any U.S.-China decoupling.

“When the history is written of this period, the decision by the administration on the 7th of October to ban high-technology exports to China is a tipping point,” Rudd said. “It’s a central development, which we will look back on in the evolution of not just technological decoupling, but wider economic decoupling.”

Edited by Malcolm Foster.

[圖擷取自網路,如有疑問請私訊]

|

本篇 |

不想錯過? 請追蹤FB專頁! |

| 喜歡這篇嗎?快分享吧! |

相關文章

AsianNewsCast